10 Things In Tech: Startups Are Facing Extinction In Great Numbers

Most people are blind to the “Mass Extinction Event” that startups are currently experiencing. It’s because startups aren’t publicly traded businesses. A stock price decline cannot be observed in real-time. You can, however, observe the gradual trainwreck in progress if you look carefully. For startups, this is the very start of the end. Tom Loverro, a general partner at IVP, claimed as much, stating that “the mass extinction event for startups is underway.” Loverro also mentioned that startups perish gradually and subtly. While they bet on a select few emerging as the next Meta or Twitter, VCs have a history of letting startups wither in their portfolios.

From unrealistically low levels in 2021, the new business failure rate is now starting to rise, and the following year may see an eruption of capitulation in which an extremely high percentage of firms fold. Based on a subsequent tweet from Tom Loverro, a general partner at IVP, which has supported firms like CrowdStrike, Datadog, Discord, Klarna, Slack, Snap, and Twitter, “The Mass Extinction Event for startups is underway.” Most of the time, it is a footnote in the news. Be not deceived. The marketplace has evolved. Funding announcements frequently make the news. Less so are bankruptcy filings. His observation was converted into a fantastic narrative by The Wall Street Journal.

As Loverro points out, startups go away slowly and subtly. They also frequently shut down. While VCs tweet about the most recent M&A or IPO exit, their portfolios contain many more budding companies that fade in the background. This is how venture capital should operate. Many businesses are supported by VC funding, and most of them are expected to fail. To make significant profits, they require just a select few to succeed as the next Meta, Twitter, or Snowflake. As a result, starting failures occur at a natural pace. The issue is that this natural order was thrown out of balance by the VC boom, which peaked in 2021. Startups raised enormous sums of money during an investment frenzy, and some companies received capital that perhaps they shouldn’t have. The failure rate fell as VC funding poured in from all directions. Although there were numerous more players, SoftBank and Tiger Global were the two main ones.

The money supply has now dried up (unless you operate an AI startup, of course). Startups have a long runway to survive thanks to the large amount of money that was raised in recent years. However, struggling companies eventually run out of money and nobody wants to invest in them again. A slew of painful asset sales, unpleasant cram-down recapitalizations, incredibly inexpensive acqui-hires, and yes, straightforward shutdowns and bankruptcies, will result from this. Since startups are not publicly traded firms, you cannot currently watch this slow-motion train catastrophe in progress. There isn’t a stock price you can follow to see fortunes fall apart in real-time.

The tech sector is renowned for being competitive and fast-paced, and startups frequently become new market disruptors. They do, however, nevertheless confront formidable obstacles that may cause them to go extinct.

A few of the common reasons for the high startup mortality rate in the tech sector are listed below:

Rapid Technical Progress: Since trends and breakthroughs in technology change quickly, startups must stay current. A startup’s product may become obsolete if it does not adapt to shifting client preferences or rising technologies.

Insufficient Funding: To create and scale their goods or services, startups frequently need significant financial resources. They can run out of money before being sustainable if they don’t obtain enough funding or manage their money poorly.

Competition: The tech industry is rife with competition as established businesses and other startups fight for market dominance. It can be challenging for startups to differentiate themselves from other companies and garner enough support from the market to last.

Unrealistic Expectations: Startups may encounter issues if they have “unrealistic expectations” following a significant accomplishment. Remember that achievement is transient and that dreams never end. Startups are required to translate the genuine expectations in this situation. Being as sustainable as feasible is the aim. Furthermore, sustainability necessitates constant work.

Financial Administration: There is a money cycle. Keep in mind that expenses rise along with an increase in income. There is no question in my mind. Financial management has become the biggest primary challenge businesses face today. In actuality, small businesses rely heavily on the financial assistance of these so-called investors. Small firms, especially startups, may find it difficult to manage their finances well during times of financial infusions and succumb to the pressure.

Hiring fault: There is a sizable pool of aspirants available. It’s a rather difficult assignment to choose a candidate who suits the job well enough. It is one of the biggest issues new businesses face in the digital age. When choosing a suitable candidate, organizations need to remember the axiom that “birds of a feather flock together.”

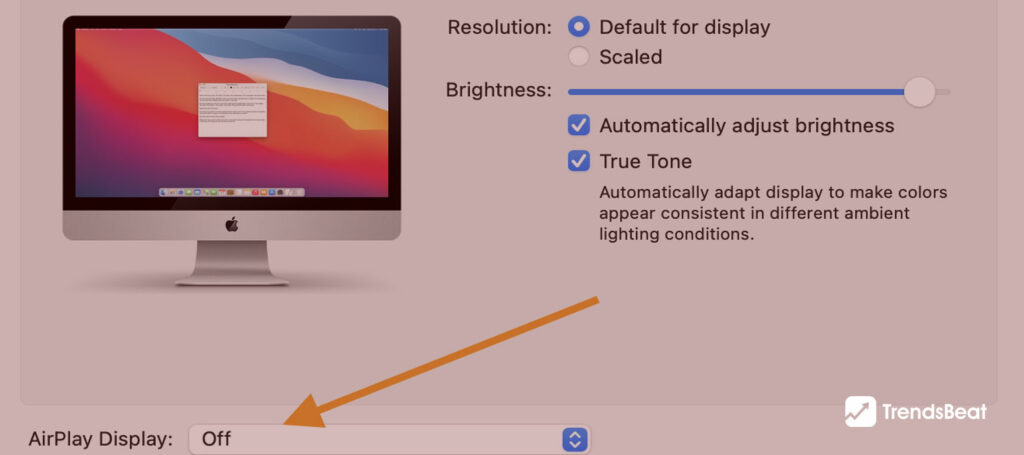

Cyber Issues: The digital era is now. Small companies, particularly those operating online, must be extremely nimble to combat the so-called dangers to online security if they are to survive the rigors of this period. Hackers are omnipresent, and they will exploit any security flaw in a new company’s computer systems. Online-active startups are susceptible to threats to their security. They are vulnerable to unauthorized access to sensitive startup data, personnel records, bank account information, and any other information deemed necessary for the existence of a digital business.

Customer Engagement Crisis: The primary driving force behind a startup’s success is its customers. Due to their online presence and ability to leverage word-of-mouth marketing, tech companies may have an edge over all traditional businesses. Startups must make a concerted effort to adopt a customer-focused working attitude if they are to achieve the highest level of sustained development and advancement they desire in this proficiency in technology and demanding business climate.

![Essential-Cybersecurity-Tips-for-Small-Businesses-[Protect-Your-Data]-TrendsBeat](https://trendsbeat.com/wp-content/uploads/2023/05/Essential-Cybersecurity-Tips-for-Small-Businesses-Protect-Your-Data-feature-image-template-1024x455.jpg)

![Top Fitness Trends & Workout Routines to Follow [Stay Fit, Stay Healthy]](https://trendsbeat.com/wp-content/uploads/2023/04/feature-image-Top-Fitness-Trends-Workout-Routines-to-Follow-Stay-Fit-Stay-Healthy-1024x455.jpg)

![[Weight Loss Medication Health Effects] Side Effects and Best Advice](https://trendsbeat.com/wp-content/uploads/2023/04/feature-image-Weight-Loss-Medication-Health-Effects-Side-Effects-and-Best-Advice-1024x455.jpg)